OktoPOS Manager – Your Digital Management Center

The OktoPOS Manager is the core of our powerful management software. With comprehensive features for inventory management, employee administration, customer relations, and in-depth analytics, you stay in full control at all times.

Optimize workflows, make informed decisions, and streamline your daily operations – all from one centralized system. Experience total control with OktoPOS!

OktoPOS Manager

Your Web-Database and POS System Management Center

With the OktoPOS Manager, you can manage branches and franchises efficiently from one central system – even internationally. Whether inventory, staff, or analytics: all data is unified in one platform. Scalable, multilingual, and built for multi-location operations – ideal for growing businesses with global ambitions.

Business Cloud Computing

The OktoPOS Manager is a central, web-based platform that enables the management of all front-end systems.

Access from anywhere: The OktoPOS Manager is accessible through any standard browser via a secured internet connection.

Branches and Franchises

OktoPOS is used by Single-Unit, Multi-Unit and Franchise Systems.

International

OktoPOS can be Used in different Countries.

Inventory Control and Management

Efficiency, Consistency and Control through Integration of Materials Control and Cash Registers.

Materials management is a challenge for branch operations with a high volume of small transactions.

The integration of materials management with the cash register is a must. OktoPOS Cash uses article data from the central OktoPOS Manager database and feeds it with consumption values in return. This is the basis for a functioning materials management.

Consumed articles can be dissolved into their ingredients listed in their recipe. Deliveries and waste are recorded. With this data, a stock account is maintained for every article. After stock count, deviations between expected vs. actual amounts and values is displayed.

The quality of the results depends on the quality of the entered data. For complex and non-standardized production processes, deviations of expected vs. actual quantities are often tolerated.

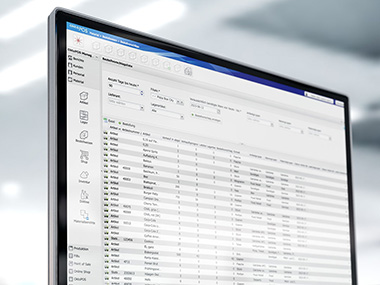

Inventory with expected vs. actual values

Inventory

Inventory is managed using physical count lists or by entering stock amounts directly in the OktoPOS Manager. Moreover, a mobile device (Android) can be used to capture the inventory by barcode and export it to the OktoPOS Manager. Deviations between expected vs actual amounts / values are displayed. The materials account of a given article can be opened directly from the inventory for deviation analysis.

Inventory valuation is carried out using provided article prices. The inventory comparison function displays the resulting changes in inventory value and booking list for financial accounting purposes.

Purchase Order Recommendation

The purchase order recommendation list considers the sales of the last days and the stock levels. Articles that have a recipe are broken down in the ingredients.

The purchase order recommendation list can be edited manually and be sent by e-mail to the suppliers.

Purchase Order Recommendation

Entry of waste on the cash register

Waste

The expected / actual comparison can only be correct if not only the sales are automatically recorded via the cash register but also waste / breakage.

Waste and breakage can be recorded either directly through the cash register or in the OktoPOS Manager.

At the cash register not only sales items can be recorded as waste but also ingredients.

Waste Lists are Reported in the OktoPOS Manager.

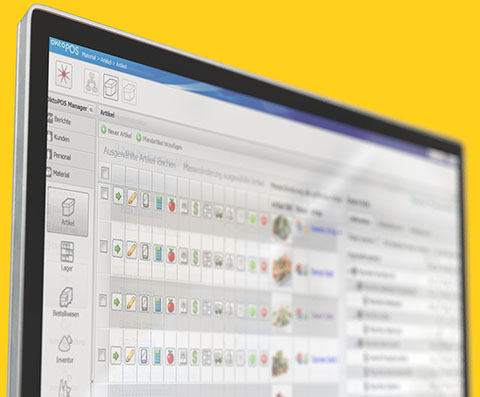

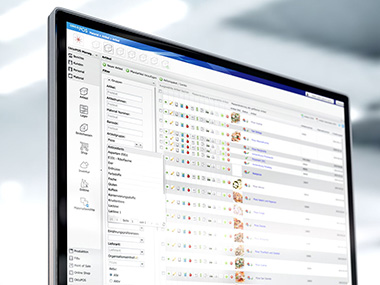

Articles

An article possesses various attributes which conventional cash register systems do not take into account. In the OktoPOS Manager, the various attributes are entered directly in the article file and are thus available for the other modules.

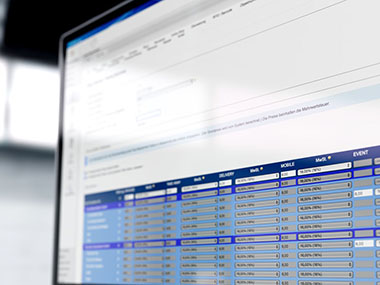

Prices

An article can be sold in various ways. This may trigger different prices and VAT rates. To avoid creating a separate article for each distribution option, various prices and VAT rates can be entered that depend on the following parameters:

- Branch

- Distribution channel (in-house, take away, delivery service, etc.)

For each branch, the currency can be defined. Thus, the same article can be sold internationally in different branches and different distribution channels. This enables comprehensive article reports.

Price table for an article

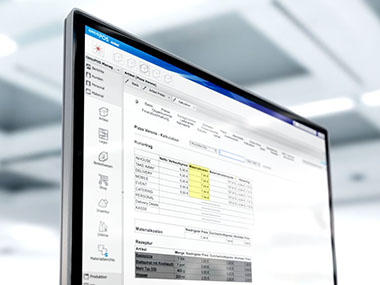

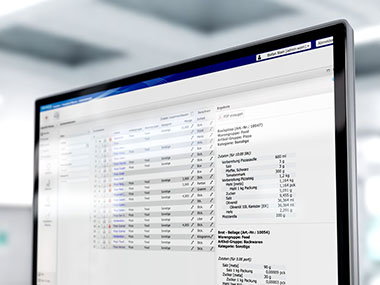

Product Calculation

The system calculates the material-cost-ratio for each article. The gross margin report lists daily gross margin results for every article in every branch.

Product calculation by recipe

Features

- Article administration

- Supplier administration

- Inventories

- Storages

- Expected vs. actual analysis

- Order recommendations

- Recipes

- Prices

- Allergens

- Nutritional values

- Additives

- Expiration dates

- Product calculation

- Gross margin calculation

- Deliveries

- Waste

- Production planning

Overview of contribution margin

of sold items in a selected time period

Manage Recipes, Nutritional Values & Allergens

Keep full control over your recipes with centralized management of ingredients, nutritional values, and allergens. Our software ensures clear labeling and easy updates – perfect for hospitality and retail. Stay compliant with regulations and offer your guests maximum transparency and safety.

Recipes can be stored in the article file for all articles produced or modified in the branch

This enables the following:

- Consumption of ingredients

- Definition of contained allergens by the recipe

- Definition of contained additives by the recipe

- Calculation of nutritional values by the recipe

- Identification of non-vegetarian and non-vegan articles by the recipe

- Product calculation by the recipe

Recipe / parts list in the article file

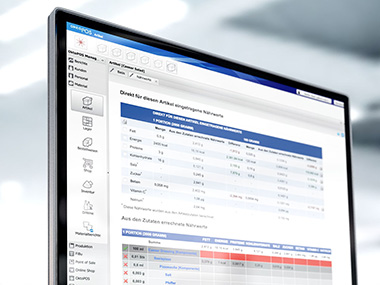

Nutritional Values

Nutritional Values of the End-Products can be Calculated by the Recipe.

Nutritional values can be entered for each article.

Calculation of nutritional values in the article file

End products nutritional values are calculated using the recipe. Since these values do not necessarily correspond to the total nutritional values of the ingredients, they can be corrected manually in each step.

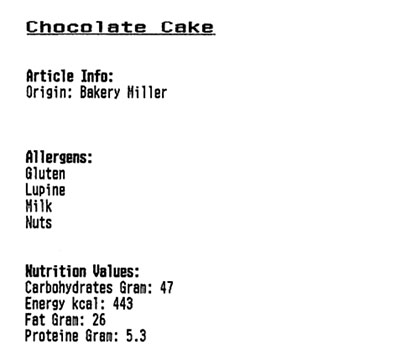

Publication

Nutritional values can be used for the following purposes:

Printout of the article information via the receipt printer

Indication of nutritional values in the cash register

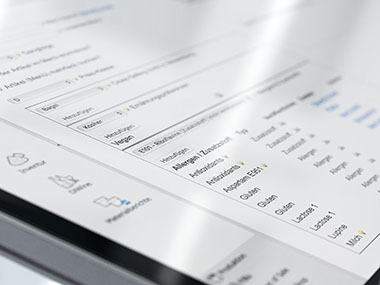

Allergens & Additives

Allergens and Additives can be Calculated through the Recipe.

Allergens and additives can be entered for each article. The system uses the recipe to determine the allergens and additives that are contained in the end-products.

Tracking allergens and additives in complex recipes is barely possible without the support of a powerful system.

The information about allergens and additives can be used for the following purposes:

The article database can be filtered by allergens and additives. Thus, all articles that contain a certain allergen or additive can be found at the click of a button.

Filtering the article database by allergens

Determination of allergens in

the article file through the recipe

Production Control

Stay in full control of your production with our intelligent management system. From production planning and restocking to automated ordering, the software ensures smooth workflows and optimal inventory levels. Label printers allow for fast and accurate product labeling directly during production. Save time, avoid shortages, and improve your process quality – ideal for businesses with in-house manufacturing or processing.

Replenishment System

OktoReplenish is the ideal solution for reordering materials in production storage.

Production teams can order articles through a terminal by selecting them via article buttons and sending the order. These orders are then displayed on the inventory monitor for processing.

Material consumption can be tracked through inventory management using material movements.

OktoCapture

OktoCapture records production output quantities. This is used for inventory management and statistics.

The data is recorded with a touchscreen terminal on which the production items are available as buttons. Alternatively, the items can be captured via barcodes with a scanner.

Articles can be recorded as pieces, weight or volume. Optionally, variants of the article (e.g., colors, sizes, etc.) may be captured.

OktoCapture is directly connected to the OktoPOS material management system. In the inventory management, the stock-level is tracked and inventories are entered. The produced articles are broken down in the inventory management via the recipe or parts-list into their components.

Each transaction can be automatically exported to a third-party system (for example, SAP or Oracle) in real time.

The OktoPOS Manger provides a variety of reports.

Procurement

Create Orders Directly from the System.

Suppliers

Each supplier has a dedicated supplier record. In this record, the articles supplied and the purchase prices for each branch are managed.

Order Proposals

The system automatically calculates order proposals based on the sales. These can be adopted for orders.

Purchase order recommendation

Orders

Orders can be generated as a PDF and sent by e-mail to the supplier.

It is possible to transfer orders directly to the material management system of the supplier. For this an individual connection of the supplier is necessary.

Mobile Device

With the MDE device (mobile data collection device), reorder quantities can be recorded and transferred to the OktoPOS Manager in order to generate an order.

Deliveries can also be scanned with the MDE device and saved as a delivery note in the OktoPOS Manager.

Production Planning

Calculate Ingredient Quantities

With the ingredient calculator you determine the demand for ingredients for a selected production quantity of one or more products.

When calculating several products at the same time, the quantities of ingredients can be cumulated.

Ingredient calculator

Label Printer - OktoLabel

Labels for Packaged Foods.

OktoLabel

An article is selected on the touch-screen and the number of labels is set. The printer produces the labels with all relevant information like price, price per unit, quantity, ingredients, additives, allergens, nutrition values, expiry date and barcode.

Features

- Connected to the OktoPOS Manager article database

- Connection of label printer

- Connection of scale (optional)

- Price

- Price per unit

- Quantity

- Expiration dates

- Ingredients

- Additives

- Allergens

- Nutrition values

- Barcodes

- Etc.

System Requirements

Employee Management

What you achieve with it

- Less effort, more clarity: Manage staff scheduling, working hours, absences, and allowances transparently.

- Recruit faster: Publish job postings on your website and structure the application process.

- Better onboarding: Checklists ensure structured training – without paper chaos.

Functions at a glance

- Shift planning

Intuitive planning with clear responsibilities – for service, kitchen, or sales teams. - Integrated time tracking

Record working hours centrally and document them reliably. - Vacation & absence management

Coordinate vacation days and absences clearly – avoid conflicts, identify gaps early. - Time accounts

Manage target and actual working hours minus sickness and vacation in time accounts. - Allowances

Calculate and document allowances automatically. - Recruiting & applicant management

Create job postings and present them on your website. Manage applications centrally – from preselection to acceptance. - Onboarding with checklists

Digital employee checklists for a smooth start of new team members.

Your benefits

- All in one tool: From shift planning to onboarding – without system disruptions.

- Save time & reduce errors: Clear processes, less rework.

- Structure for the team: Everyone knows when and where they are scheduled – vacations and allowances are clearly managed.

OktoPOS offers comprehensive employee management, integrating all essential functions from shift planning and time tracking to managing vacation days and allowances. Create job postings directly in the system and seamlessly present them on your website.

Our system helps you streamline team organization with ease. Integrated time tracking, intuitive shift planning, and clear vacation management keep everything under control. Manage bonuses and allowances transparently and automatically. The digital employee checklist ensures smooth onboarding for new team members. Save time, reduce errors, and bring structure to your daily HR tasks.

Additionally, the integrated recruiting module significantly eases applicant management. You receive targeted support in selecting and managing candidates, which optimizes and simplifies the entire recruitment process.

Employee files are stored centrally in the OktoPOS Manager. Thus, the data is available throughout the system without redundant entry. From shift planning to time recording and cash register logon.

Employee Data Base

Employee login at the cash register

Contract Administration

The history of key contract data is stored in the employee file. This also serves for the calculation of labor-cost-ratios and for other reports.

Time and Attendance - OktoTime

Time Recording with a Tablet Computer App.

The time recording terminal OktoTime is connected to the OktoPOS Manager over the internet. New employees are entered in the OktoPOS Manager. The log times are directly visible in the OktoPOS Manager providing an overview of employees currently at work.

With OktoTime, you get an overview of the worked time and the related personnel cost. The logged hours are valued according to contract data.

The logged times can be used for payrolls.

Time Recording Logs

The employee's time logs are available individually and cumulatively. The direct internet connection of the terminals makes reviewing log status in real time possible.

Features

- Employee selection

- Function selection

- Log-in / log-out

- Logging with contactless chip card (RFID)

- Employee files are managed in the OktoPOS Manager

- Time recording data is sent in real time to the OktoPOS Manager

- New employees are available on the terminals directly after creating a new employee file in the OktoPOS Manager

- Reporting in the OktoPOS Manager

- Personnel costs

Overview of logged hours

System Requirements

Working time accounts – Keeping track of plus/minus hours

With the working time accounts in OktoPOS, you always keep a transparent overview of overtime and undertime. The balances are calculated directly from the recorded working hours as well as vacation and sick days, and are clearly visible for each employee. You can manage the adjustment flexibly according to your company agreements.

Shift Planning

Integrated Shift Planning linked to Employee File and Sales.

Shift plans can be created easily in the OktoPOS Manager. Simply drag & drop staff in the slots of a pre-defined time slot.

Weekly plan

Only staff that has the required qualification is available. The system checks for double entries and other restrictions dynamically and issues warnings accordingly.

Shift Plan Overview

In the overview, the shift plan for a week can be seen. The entire shift plan can be copied to another week with a click. This may apply to all or only selected functions as required.

Shift Planning Bar Chart

The bar chart offers a good overview to ensure efficient shift planning by avoiding over- and understaffing.

Weekly bar chart

My Shift Plan

Employees can see their scheduled times and places online.

Warning message for shift plan restrictions

Restrictions

Different types of restrictions of single employees can be considered for the planning.

The shift planner will see a warning message should the employee be on vacation or have reached his working hours limit.

In the system configuration section, restrictions can be adjusted to only issue warning messages or to block employees from being staffed altogether.

The following restrictions are available:

- Holiday

- Sickness

- Birthday

- Rest periods

- Colleagues

- Branches

Publication

The shift plan can be published in the following ways:

- Printout

- Online

Planning Aids

Aside from the restrictions, there are other useful tools, supporting the shift planning.

These include information on the number of contractual hours, functions the employee is qualified for, branches and functions the employee has experience in as well as information on possible substitute employees.

Employee’s experience

Features

- Planning in weekly overview

- Planning by functions

- Conflict management

- Employee restrictions

- Copy function

- Accumulation of hours by employee

- Bar chart

- Employee access (“My Shift Plan”)

- Distribution of shift plan by e-mail

- PDF shift plan

- Reports by branches and functions

- Shift templates

- Sales / labor cost / labor cost ratios

- Planning aids (information about employees)

Holiday Accounts

Tracking of Vacation Allowances.

The yearly vacation allowance and expiry is calculated from the contract data.

Absence days (sickness) can be kept track of as well.

Vacation requests and sickness leave periods trigger warning messages in shift planning if the employee is staffed for a time when he will not be available.

Holiday account in the employee file

Benefit Management

Easy Reconciliation of Surcharge Payments with actually Worked Hours.

With the surcharge management function, you can calculate tax-privileged surcharges during public holidays and night shifts.

This function is directly connected to OktoTime.

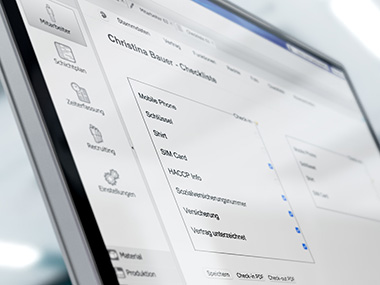

Checklists

Tracking of Items that are handed out to Employees.

A checklist in the employee file. Items handed out to and returned by employees can be entered for tracking. (e.g. keys, uniform, etc.).

Checklist in employee file

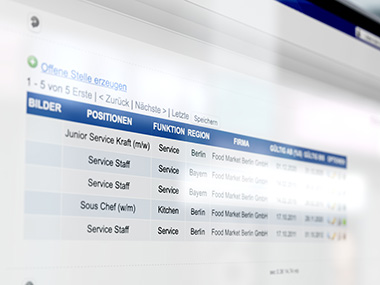

Job Postings & Smart Recruiting

Find the right talent quickly with our integrated recruiting tool. Publish job ads directly through the system and manage applications centrally and clearly. From first contact to hiring, you stay in control of the entire process – efficient, modern, and time-saving.

You can create job ads for vacancies that can be posted on your website. Applications can be sent through the website directly to the OktoPOS Manager. Incoming applications are managed in the OktoPOS Manager.

Vacancy Management

Recruiting

Applicant Management

OktoCareer - Personnel Consulting Software

With the separate OktoCareer module, you have a professional applicant management system at your disposal:

- Job advertisements on your own website and on job exchanges

- Applications received via the website, job exchanges and by e-mail

- Creation of an applicant file

- Electronic analysis of the CV

- Legally compliant obtaining of consent to data processing

- Deadline management for data protection and legally compliant deletion

- Integrated communication with applicants via email

- Evaluations of candidates

- Maintenance of long and short lists

- Creation of a pool of candidates

- Management of vacancies

- Resubmission function

- Outlook connection

- Reporting

The OktoCareer module is suitable for companies that receive 10 or more applications per month. With OktoCareer you keep an overview, don't miss any deadlines and ensure a professional appearance on the labor market.

- Keep track of the applicant

- Don't miss any more deadlines

- Professional appearance on the job market

- Better decisions through more information

Stay in Control – Analytics and Reporting Tools

Our software delivers robust analytics, clear reports, and effective controlling features to support informed decision-making. Tailored tools for tax consultants and seamless accounting exports simplify financial workflows. Combined with an integrated content management system, you stay on top of your data, communication, and content. More clarity, less effort – with our all-in-one solution.

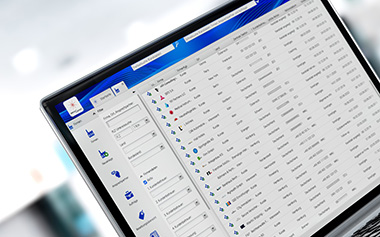

Reporting

Comprehensive Real Time Reporting.

Anything any Time

The OktoPOS Manager enables access to reports on a wide variety of topics that are always up-to-date. Even sales made just seconds ago are immediately included in the reports. Thanks to the high computing power of the server and optimized program structures, even complex evaluations can be performed in a flash.

For individual further processing, reports can easily be exported to Excel. Additionally, it is possible to create PDF documents for documentation from most analyses. Since data from all modules flow into the OktoPOS Manager, reports are also possible that combine data from different areas, such as the labor cost ratio or product calculations.

Monthly sales

Control

Control happens when the relevant information is coming to you, and you do not have to gather the information you need. Due to the multitude of processes and transactions of different kinds in a branch, it is impossible to keep control without an efficient and interconnected system.

Subscribe to the management report that delivers you the KPIs you need by daily e-mail. Use the drill-down function to gain a deeper insight. Since all data is available in one single system, it is possible to drill down to the raw data.

Use the combination of data to your advantage. For instance, analyze the margins report to determine on which days which articles contribute the most -or least- to your profits.

Through the differentiated rights structure, you can define which employee has access to which data of which branch. More than 50 reports are available in the OktoPOS Manager.

Controlling

Maximum Transparency by linking Data from various Modules.

Proforma P&L

Managers of multi-unit operations know the importance of current data and how difficult it is to get it.

OktoPOS delivers the information fast and complete like no other system. OktoPOS provides the compass you need to keep your company on track.

From bean counters to visionaries

Effective management needs to not only see the big picture, but also pay attention to details. Thanks to the integrated approach, OktoPOS offers the complete spectrum. From profitability of a branch to the single transaction.

Drill Down

For a better understanding of the reports, you can drill down to individual transaction records.

Proforma P&L

You can see your daily P&L for each branch in the OktoPOS Manager. The required data comes from the cash register, articles, recipes and purchasing prices as well as personnel cost according to time and attendance and employment contracts. Occupancy cost, depreciation and other cost are defined as a lump sum or in relation to sales individually for each branch.

The only cash register that not only shows sales but bottom line success.

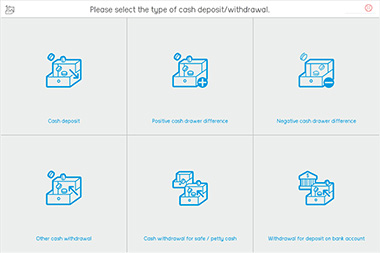

Electronic cash journal - OktoJournal

With the electronic cash journal module OktoJournal you fulfill the legal obligation to keep a cash journal. Cash balances as well as deposit and withdrawal receipts are recorded directly at the cash register and stored in the cloud in accordance with the law.

OktoJournal is your electronic cash journal with entry on the touchscreen. For cash registers and vault books.

No more hassle with handwritten notes.

All deposit and withdrawal receipts from the cash register are recorded via the touchscreen and stored in the cloud.

No tedious fiddling with mouse and keyboard. The Touchscreen OktoJournal recording terminal stands directly next to the cash register. This ensures that every document is actually posted immediately.

Avoid the rejection of your accounting by the tax office due to formal deficiencies in the cash journal.

Cash journals must not be kept in Excel. The records are to be recorded promptly and unchangeably. All records must be stored securely.

Frontend

Home page

Backend

Cash journal in the cloud

Evaluation in the cloud

Management of settings in the cloud

OktoJournal is a recording terminal with an electronic cash journal for cash registers or cash registers without recording sales tax.

FAQ - Frequently Asked Questions

For Tax Consultants

Functions and Information for Tax Consultants

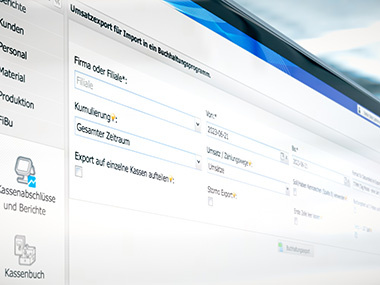

Accounting Export

Export Sales to the Financial Accounting at the Push of a Button

The sales export makes the work for financial accounting much easier.

Sales are exported from the OktoPOS Manager as a CSV file and imported into the accounting program.

The export can be set to be compatible with all accounting programs, including Datev of course.

Setting options for sales export

Sales can be exported in one go for multiple days and multiple stores.

To set up the export function, simply enter the chart of accounts in the OktoPOS Manager and assign a revenue account to each sales article based on its VAT rate. This way, you can easily break down your sales in your P&L by goods groups or categories, depending on your needs.